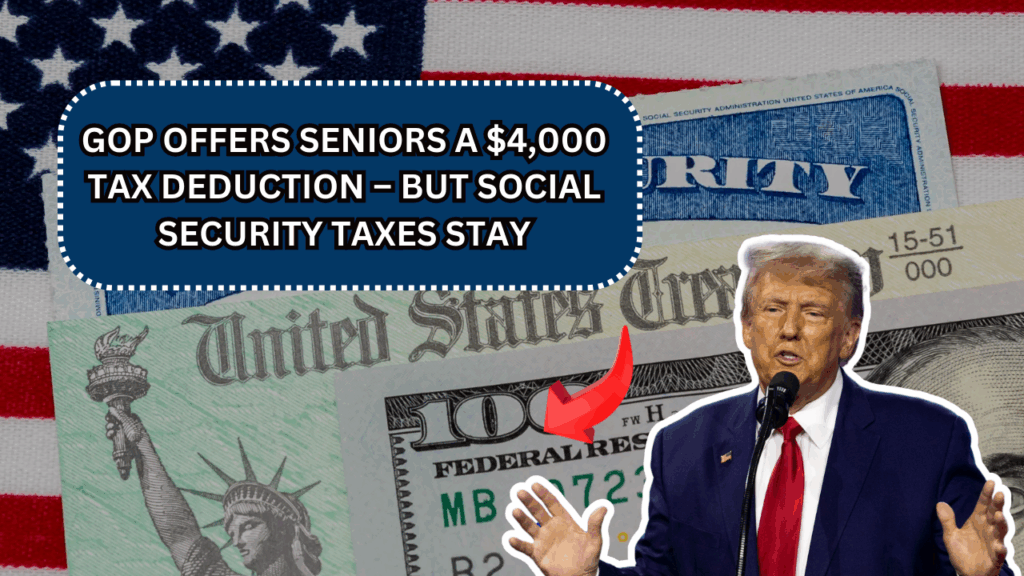

The Republican Party is introducing a major new tax proposal aimed at helping working families and retirees. Known as the “One Big Beautiful Bill,” this legislation includes several tax breaks, including a $4,000 tax deduction for Americans aged 65 and older. However, despite earlier political promises, the bill does not eliminate federal taxes on Social Security benefits.

Here’s a full breakdown of what the GOP is proposing and why Social Security taxes are still on the table.

What the GOP Tax Plan Offers Seniors

One of the biggest highlights of the bill is a $4,000 tax deduction for seniors. This new benefit would be available starting in 2025 and last through 2028, giving retirees some financial relief for the next few years.

- Eligibility:

Individuals who are 65 years or older will qualify. The deduction applies to both those who use the standard deduction and those who itemize their tax returns. - Income Limits:

The full deduction is available for single filers earning up to $75,000 and joint filers earning up to $150,000. Above these limits, the deduction is phased out.

According to Republican lawmakers, this change is meant to ease the financial burden for retirees living on fixed incomes.

Other Tax Relief Measures in the Bill

In addition to the $4,000 deduction, the bill includes several other temporary tax breaks designed to support middle- and low-income households:

- No federal tax on tips and overtime pay

- Car loan interest deduction for U.S.-assembled vehicles

- Increased standard deductions

- Expanded Child Tax Credit

These provisions are also scheduled to expire after 2028, unless renewed by Congress.

Why Social Security Taxes Are Still in Place

Despite earlier campaign promises including from former President Donald Trump the GOP bill does not eliminate taxes on Social Security income. There are two main reasons for this.

Budget Reconciliation Restrictions

The bill is moving forward through a process called budget reconciliation, which allows the Senate to pass tax changes with a simple majority. But under the Senate’s Byrd Rule, any changes to Social Security are not allowed in reconciliation.

This means a separate bill would need to be introduced to remove Social Security taxes and that bill would require 60 votes in the Senate to pass. With the Senate evenly divided, this would be nearly impossible without bipartisan support.

Financial Impact

Social Security benefits are currently taxed based on income levels, and this generates significant revenue for the federal government. In fact, Social Security taxes bring in around $50 billion per year. This money helps support both the Social Security Trust Fund and Medicare.

Removing those taxes would require finding another source of funding or risk reducing benefits for current and future retirees.

How This Affects Seniors

Let’s look at what this means for seniors in real-world terms:

| Income Level | Eligible for $4,000 Deduction? | Will You Still Pay Tax on Social Security? |

|---|---|---|

| Under $75,000 (single) / $150,000 (joint) | Yes | Yes, if provisional income exceeds IRS limits |

| Over income limits | No – deduction phased out | Yes |

Provisional income includes half of your Social Security benefits, other taxable income, and some non-taxable income like municipal bond interest. If your provisional income exceeds $25,000 (individual) or $32,000 (married filing jointly), up to 85% of your Social Security benefits may be taxed.

The Bottom Line

The proposed GOP tax bill gives seniors some immediate relief through the $4,000 deduction, along with other temporary tax breaks. However, it falls short of eliminating taxes on Social Security income, a move that many retirees had hoped for.

While the deduction may help reduce taxable income for seniors earning under the threshold, those with higher incomes and those receiving significant Social Security benefits will likely continue to see part of their retirement income taxed.

To truly remove Social Security taxes, a separate piece of legislation would be needed and that would require more political support than currently exists in Congress.

Conclusion

This legislation is still making its way through Congress. Seniors and those nearing retirement age should keep a close eye on future changes, especially as the 2024 election cycle could bring renewed focus on Social Security reform.

For official updates and information, check out the following resources:

- U.S. Congress bill tracking: www.congress.gov

- IRS Tax Information: www.irs.gov

- Social Security Administration: www.ssa.gov

Would you like this content adapted into a social media post, email newsletter, or translated into Hindi? I can also provide an infographic or summary chart upon request.